Unlocking Success: Your Ultimate Guide to Forex Day Trading Strategy

In the fast-paced world of forex, day trading is a popular and potentially lucrative strategy. Traders execute buy and sell orders within the same day, capitalizing on small price movements. To become a successful day trader, you need a solid strategy, strong discipline, and a deep understanding of market dynamics. In this article, we’ll explore various aspects of forex day trading strategy, helping you to refine your approach and increase your chances of making profits in the forex market. For those eager for more knowledge, check out forex day trading strategy Crypto Trading Asia for additional resources.

What is Forex Day Trading?

Forex day trading involves buying and selling currency pairs within a single trading day. The primary goal of day trading is to profit from short-term price movements. Unlike long-term investing, which typically involves holding onto assets for months or years, day trading requires a different mindset and approach. Day traders often leverage technical analysis, news analysis, and market sentiment to make informed trading decisions.

Key Characteristics of Day Trading

To succeed in day trading, it’s essential to understand the following key characteristics:

- Time Sensitivity: Day traders must act quickly as market conditions can change within seconds.

- High Volume Trading: Many day traders engage in multiple trades per day to exploit small price movements.

- Leverage and Margin: Day traders often use leverage to increase their exposure to the market, which can amplify both profits and losses.

- Emphasis on Technical Analysis: Technical indicators and charts play a significant role in day trading strategies.

Building Your Day Trading Strategy

A well-structured day trading strategy is imperative. Here are the critical components to consider when developing your strategy:

1. Choose Your Trading Style

Different day traders employ various styles depending on their risk tolerance and experience. Some common styles include:

- Scalping: This involves making dozens or hundreds of trades a day, aiming to profit from very small price changes.

- Momentum Trading: Traders look for stocks or currency pairs that are moving significantly in one direction and join the trend.

- Range Trading: This strategy involves identifying support and resistance levels and trading within that range.

2. Define Your Risk Management Rules

Risk management is vital in day trading. Setting strict rules for how much of your capital you are willing to risk per trade is essential. Many traders recommend risking no more than 1-2% of your total trading capital on a single trade. Placing stop-loss orders can also help limit potential losses.

3. Analyze the Market

Daily market analysis is crucial for day traders. Understanding key economic indicators, geopolitical events, and market sentiment can give insight into potential price movements. Traders often focus on major currency pairs like EUR/USD, USD/JPY, and GBP/USD due to their liquidity and volatility.

Implementing Technical Analysis

Technical analysis is the backbone of most day trading strategies. Here are several essential tools and indicators that can assist you:

- Moving Averages: These help smooth out price data to identify trends over a specific period.

- Bollinger Bands: This volatility indicator shows when a market is overbought or oversold.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements.

- Fibonacci Retracement: This tool helps identify potential retracement levels during a trend.

Utilizing a Trading Journal

Keeping a trading journal can greatly enhance your day trading strategy. Documenting your trades, including the reasoning behind each trade, outcomes, and lessons learned, can provide invaluable insights for future trades. Analyzing your performance over time helps to identify patterns, strengths, and areas for improvement.

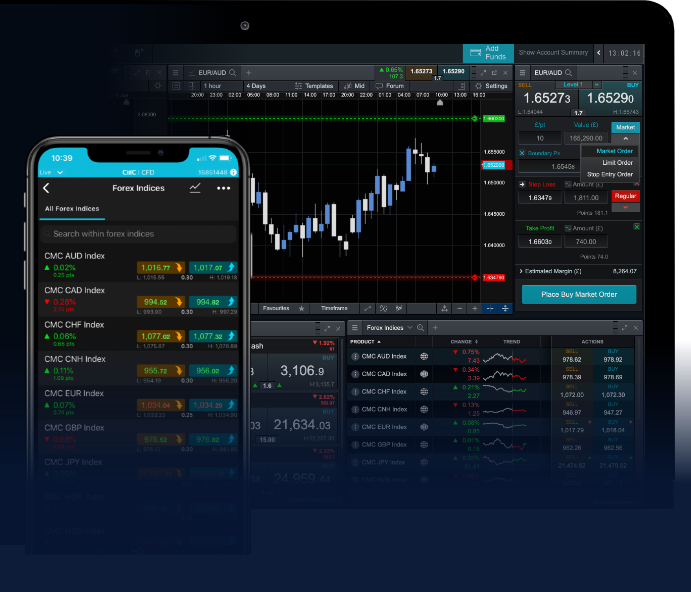

Choosing the Right Trading Platform

Your choice of trading platform can affect your trading effectiveness. When selecting a platform for day trading, consider the following factors:

- User Interface: A clean and intuitive layout helps you navigate more efficiently during trading hours.

- Execution Speed: Fast execution speeds are crucial for day trading since delays can result in missed opportunities.

- Access to Tools and Resources: Look for platforms that provide robust charting tools, technical indicators, and news feeds.

Maintaining Psychological Discipline

Day trading can be emotionally taxing. To succeed, traders must cultivate psychological resilience. Developing a disciplined approach means sticking to your trading plan and avoiding impulsive decisions based on fear or greed. Practice patience, manage stress, and give yourself time to analyze each trade critically.

Review and Adjust Your Strategy

Forex market conditions can change rapidly. Regularly reviewing and adjusting your strategy based on market conditions, personal experiences, and results is essential. Continuous learning and adapting your approach will help you stay competitive in the dynamic world of forex day trading.

Conclusion

Forex day trading offers exciting opportunities for profit; however, it requires a well-thought-out strategy, strong analytical skills, and emotional control. By building a robust trading plan, utilizing effective technical analysis, sticking to risk management principles, and maintaining disciplined trading practices, you can boost your chances of success. Remember that every trader’s journey is unique, and adapting the strategies discussed in this article to fit your personal trading style can lead to long-term success in the forex market.